In 2017, more than 2 billion adults and up to 39% of the total global population still do not have access to a bank account. In developing countries, that number is even higher.

According to the World Bank’s Financial Inclusion Database,as of 2015, almost two-thirds of the populations of just five countries Indonesia, Philippines, Nigeria, Colombia, and Peru (a combined 630 million people) remain unbanked. If one includes all middle income and developing nations,that number rises to a whopping 3 billion-plus humans without access to a bank account, let alone access to basic financial tools such as a debit card.

Despite leaps made by financial technologies in the past few decades, it is clear that accesss to simple, 21st century financial utilitiesremains shockingly low. Digital payments are the solution that will provide entryto financial inclusion for these billions of people, That said,financial exclusion still remains, in large part, because most merchants in underserved demographics still deal only in cash.

These micro and small businesses (MSMs) the local food vendors, gasoline stands, mobile phone kiosks the lifelines for most people, represent over USD 6.5 trillion in transactions annually. Yet less than 10% of these merchants currently accept digital payments.

Moreover, the current financial infraestructure further connectivity historically has been poor, and card payment fees are too high to justify operating in anything but cash. Similarly, service providers have thus seen little reason to invest in the infrastructure to bring these billions of people into the modern digital financial system.

opportunity to change that. Against a backdrop of rising Blockchain technology and crytocurrencies ofer an mobile device adoption (global smartphone user base to increase by 1.6 billion in the next 3 years), the barrier for people to potentially transact securely, transparently and conveniently has never been lower.

BELUGA aims to leverage these new technologies to develop an open source asset transferring platform.By thus providing the tools for small businesses and their customers in developing countries to go digital.

BELUGA’s mission to help the unbanked billions become part of a newer, better,and fairer global financial system. BELUGA will be fully compliant in every jurisdiction it operates in, with strict Know Your Customer (KYC) and AntiMoney Laundering (AML) processes.

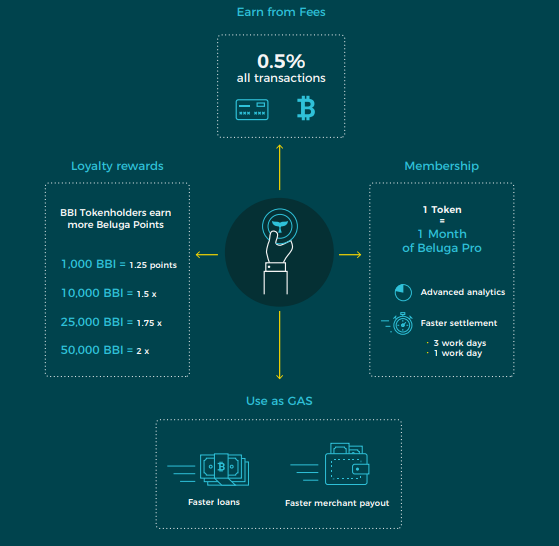

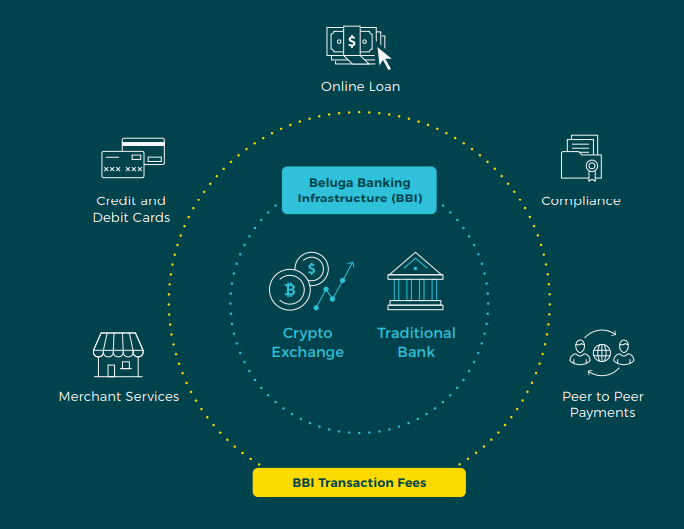

BBI Token Utility

- Membership BBI can purchase Beluga Pro membership with advanced analytics and CRM tools .

- Factoring BBI used for rewards (similar to Air Miles).

- Loyalty rewardsBBI is used to increase merchant deposit speeds, from three businesses days, down to one.

BBI Token holders Benefits

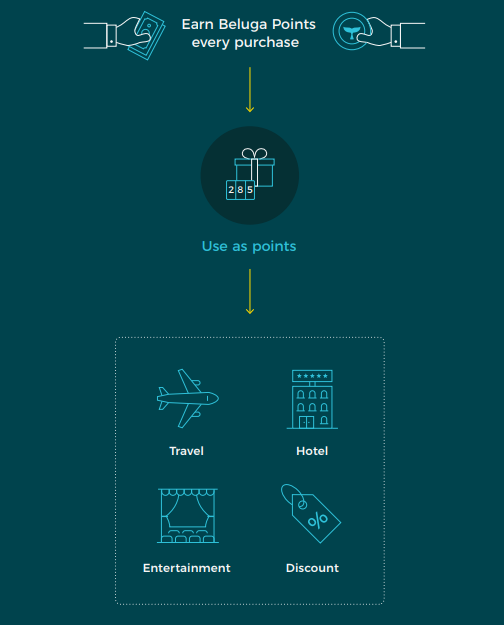

Beluga Points Benefits

BBI Example Use Case

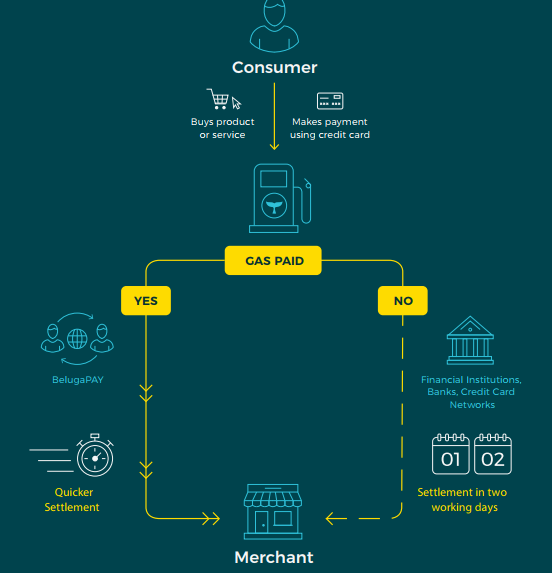

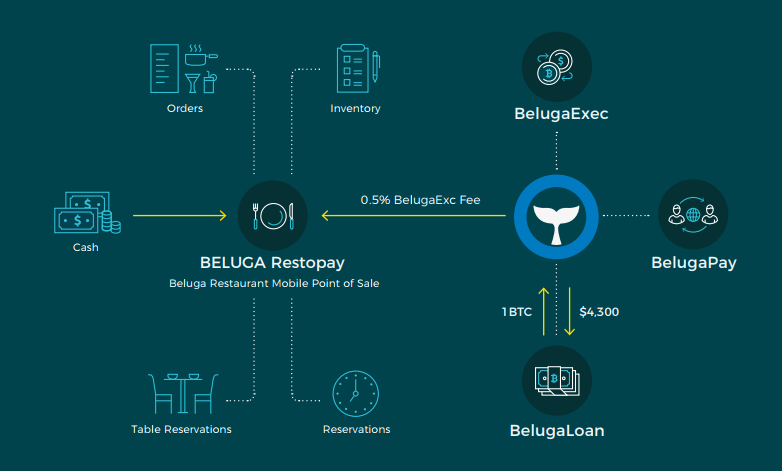

How It Works

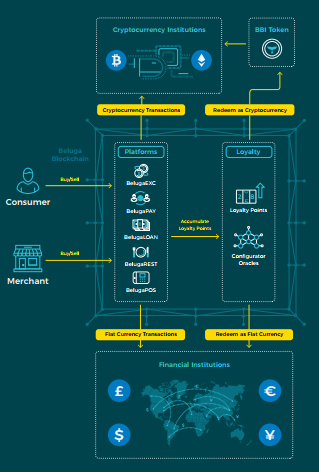

- Consumer buys a product or consumes a service from a merchant using one of our products. For example a customer orders food in a restaurant using BELUGA’s Restaurant Edition Application.

- Consumer makes payment for the product or service using Fiat Currency (ex. $USD) or Crypto currency (Bitcoin, Ether or BBI).

- If the payment is made using a credit card in Fiat Currency, the merchant can decide to use BBI tokens in order to receive an Instant Merchant Deposit* instead of having to wait the traditional two working days for the settlement to occur.

- If the payment is made using cryptocurrency, the settlement process is initiated and the payment to the merchant in the form of the respective cryptocurrency is transferred instantly.

- Loyalty points are accumulated for consumers on every purchase of a product and service. Loyalty points for merchants are accumulated on every sale of a product and service.

- Loyalty points can be redeemed when the consumer or merchant collect enough points.

- Loyalty points are redeemed in the form Fiat currencies or BELUGA’s BBI crypto currency or other cryptocurrency.

- The ratio of points with currencies is calculated using built-in configurators and Oracles based on the market dynamics.

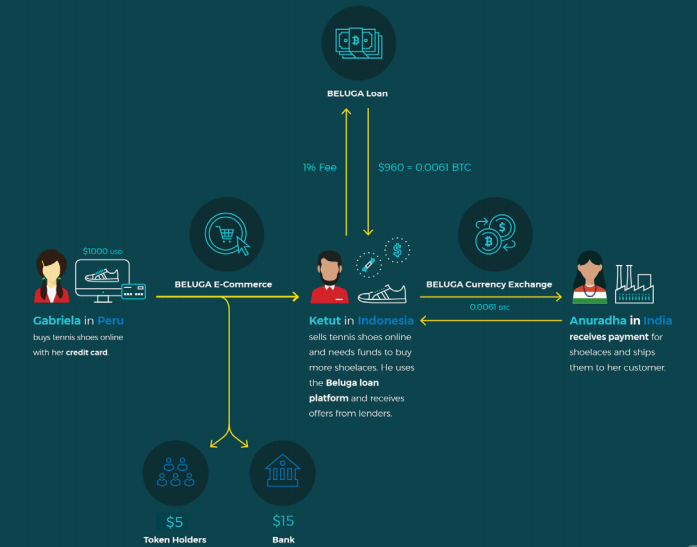

BBI Gas for Merchant Deposit Advances

BBI GAS is introduced in the BELUGA ecosystem to provide merchants an attractive and very much needed option to speed up the financial settlement process after a successful sale is made with credit cards.

Normally when a consumer buys a product or service from a merchant on a Saturday or Friday evening using a credit or debit card, the merchant will receive days, which would be on Wednesday. In the developing world the payment for the product or service after two business this lack of access to funds can cripple business growth.

Now, with BELUGA merchants can receive instant merchant deposits in order to buy more goods, pay their employees in order to grow their business without delay

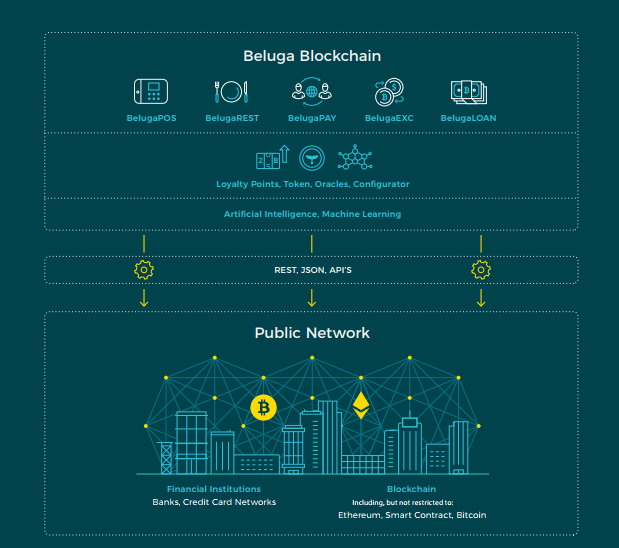

BBI Architecture Blocks

BELUGA’s solution is a Hybrid Blockchain model where capabilities are on a BELUGA Private Blockchain BELUGAcore platform along with loyalty and AI environment and the Wallets and Token Balances are kept and transferred between addresses at the Public Blockchain level.

BBI’s architecture intends to support hundreds of dierent cryptocurrencies to add exibility to cryptocurrency holders. The communication between the private and public blockchain is done through REST, JSON or other APIs

BELUGA Bank Ecosystem

Point of Sale Terminal

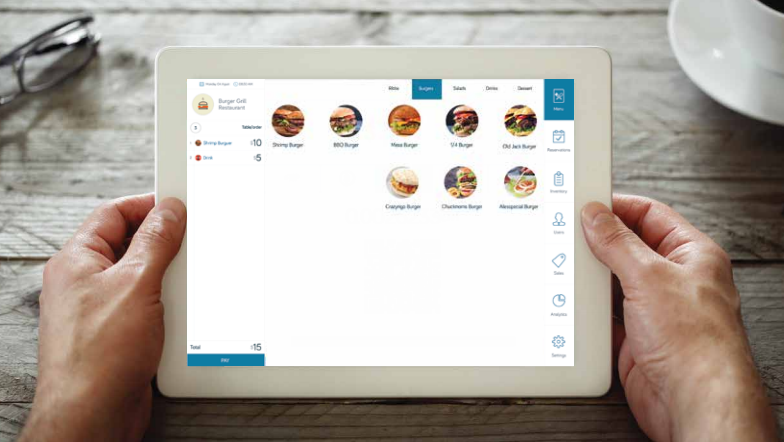

BELUGA RestoPay

BELUGA RestoPay Main Features

How BELUGA RestoPay Works

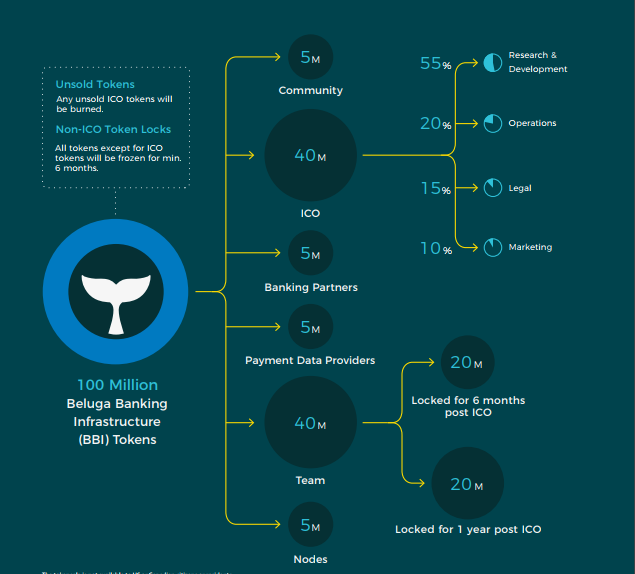

BBI Tokensale Breakdown

BBI Tokensale Details

Is held by Canadian company Beluga Inc. The IP will be transferred to a not-for-profit Beluga Foundation with a mission to advance tools and services for the unbanked merchants.

Beluga Foundation will incorporate as a not-for-profit in Switzerland or Cayman Islands which are known for IP protection, privacy laws and favorable cryptocurrency frameworks.

BELUGA Enjoys Traditional Bank Support

As opposed to other cryptobank competitors, BELUGA’s FIAT and Credit card products are live and have been in market for several years with proper banking support. In addition to having live verifiable products and licenses, BELUGA’s acquiringbank is a financial institution with over $70B in assets.

BELUGA has a partnership with Mexico’s largest domestically owned bank and publicly traded with over 20,000 employees and 1,200 branch locations Beluga’s subsidiary Espiral Technologies de Mexico S.A. De C.V. has been working with Banorte since 2015 providing Point of Sale products to merchants.

Beluga intends to replicate this model of gaining local banks’ support when entering developing countries to provide network eficiency. Through the BBI tokensale, BELUGA intends to embed crypto payments and distribute its products globally.

BELUGA Expansion Plan

Beluga believes that the largest opportunity for growth is in the developing nations where the technology exists (smartphones), however, competition from the large traditional incumbent companies have not converted a majority of the unbanked merchants.

The following represents a small sample list of countries and regions that it the profile:

Myanmar • Colombia • Cuba • Indonesia • Peru • Haiti • Ghana

Ivory Coast • Congo • Ecuador • Dominican Republic

Market Opportunity

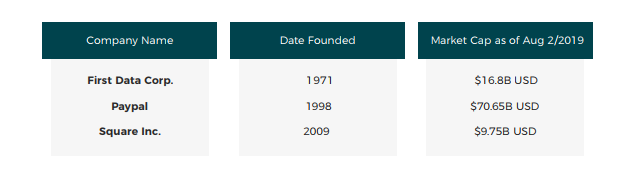

The financial technology sector is a massive and growing market There are large incumbent technology companies that serve as good markets for success but have failed to truly provide solutions for merchants in developing countries and solutions for the cryptocurrency market:

At Beluga we believe that the marriage between traditional payment systems and the cryptocurrency market presents a massive opportunity to make an impact on millions of people’s lives. The current payment processing ecosystem includes various middlemen as acquirers, issuers, gateways, card networks and ISOs.

Beluga intends to work with all necessary parties to provide the most cost eficient and secure transactions but in the future, intends to streamline the process as much as possible.

Roadmap

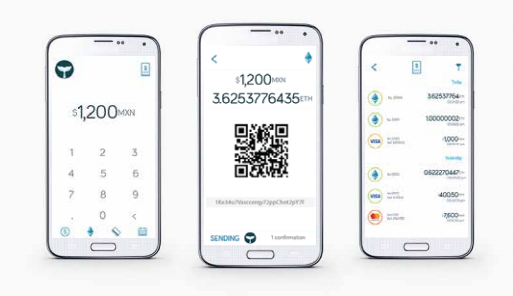

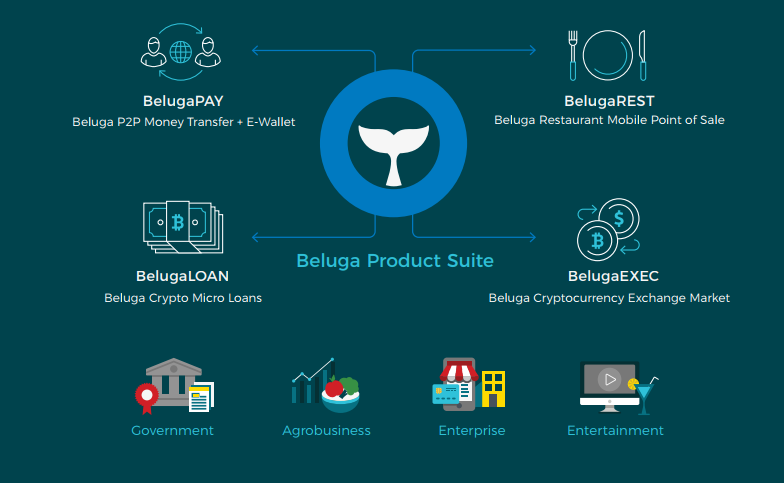

Product Overview

Beluga believes the world can be a better place with open and validated payment solutions to connect merchants, consumers in a hybrid crypto and traditional banking environment.

For the past 3 years, Beluga has developed a suite of payment tools:

Mobile Point of Sale,application for iOS,and Android

Restaurant Software to manage customers, menus and staff

Peer 2 peer payment technology

Proven Leadership Team

Beluga Foundation´s two goals:

Acquire banking technologies and licenses to remain fully compliant.

Distribute open-source banking technology to enterpreneurs and SMBs businesses.

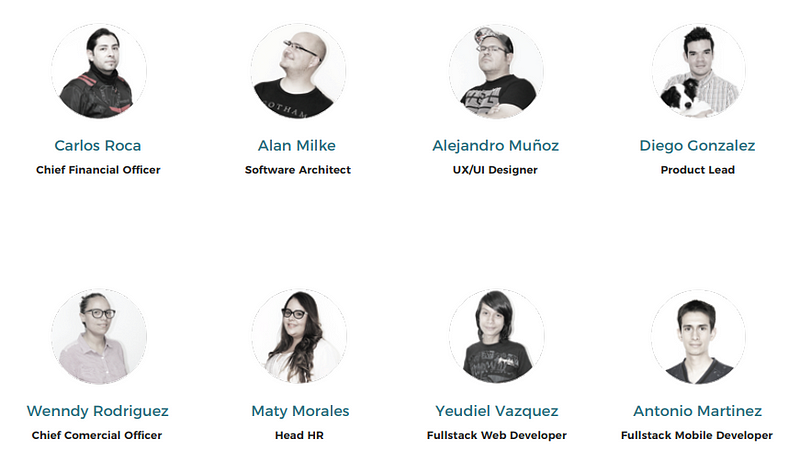

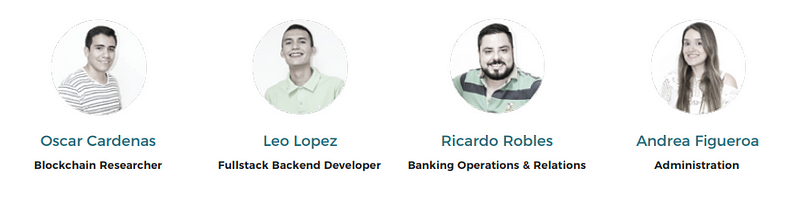

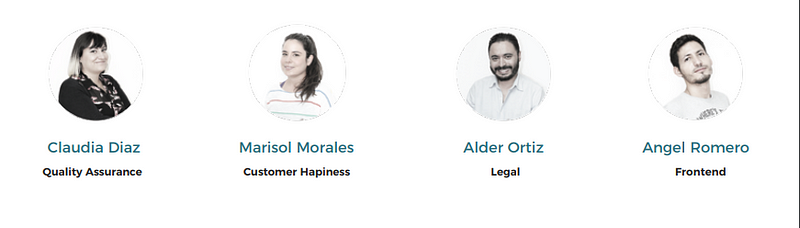

Team

Alex Avila

Chief Executive Oficer

Hugo Munguía

Chief Technology Oficer

Saravana Malaichami

Chief Data Oficer

Marifer Avila

Chief Financial Oficer

Advisors

Don Dodge

Arturo Galván

Francisco Diaz-Mitoma Jr.

Kyle Kemper

Lawrence Cisneros

Alex Yamashita

Jason Carl Kline

Details Information :

Website :https://www.belugapay.com/

Telegram :https://t.me/belugapay

Facebook :https://web.facebook.com/BelugaPay/

Twitter :https://twitter.com/BelugaPay

Profile Bitcointalk :https://bitcointalk.org/index.php?action=profile;u=1275057

Eth :0x354B4485f6133537148382d7022Be1b3c98Dbf95

Tidak ada komentar:

Posting Komentar