RegTech has a much wider scope of influence than FinTech as it is solving problems related not only to FinTech but also to a much broader range of sectors, industries and economic and human elements. Our aim is to enable a better, faster, more secure, transparent and effective way of transferring value and open up an entire new world of opportunities for the market and individuals. The ecosystem impacted by the lack of effective and efficient AML/KYC risk management for blockchain transactions covers:

- Companies accepting virtual currencies

- Banks and Financial Institutions

- Business Intelligence Companies

- New ICO’s • Smart Contracts

- New Market Entrants

- Individuals Globally

Blockchain — the solution for efficient and effective AML/CTF A global standard — the decentralized nature of blockchain and virtual currencies implies that user and transaction records may be held in many different jurisdictions, some of which may not have adequate AML/CTF controls, making it difficult for regulators and law enforcement to access them.

Furthermore, it is impractical to assign responsibility to one particular jurisdiction as blockchain transactions can pass through dozens of jurisdictions in seconds and cannot be blocked or overseen. Therefore, the only effective approach to AML/CTF for blockchain and virtual currencies must be a global standard — central reference and data access point, operating across all jurisdictions and without significant entry barriers.

AMLT/CTF is connected with risk management, not just simply strict laws, rules and regulations to follow. There is also a degree of internal assessment needed by obliged companies to build a correct risk management model. AMLT helps with compliance in an innovative way while by engaging and providing beneficial participation to the users of virtual currencies.

Vision and Mission

of Coinfirm Coinfirm provides a network that builds a transparent, democratic, effective and compliant virtual currency and blockchain ecosystem. Coinfirm’s goal is to deliver a streamlined and effective Global Standard for AML/CTF compliance in a decentralized and democratic way where participants can provide AML/CTF/Fraud/business/risk ratings whether negative or positive. Not only providing transparency and democratization of the financial system in an unprecedented way, AMLT attached to the Coinfirm AML/CTF Platform serves as a bridge to accommodating new business models and adopting blockchain and virtual currencies.

Value proposition

A token that provides access rights to the Coinfirm AML/CTF Platform, AMLT allows users to purchase reports with substantial discounts, gain exclusive access to knowledge, and allows members to evaluate market participants and obtain AMLT by providing data crucial to seamless and safe trade. AMLT is the key that in line with Coinfirm’s Platform provides solutions to problems for all participants in the ecosystem and creates the foundation for a secure, tranparent, democratic and compliant economic system.

Business Overview of Coinfirm

Coinfirm is a global RegTech enterprise focused on AML/CTF for blockchain that is functioning under the UK based legal entity, Coinfirm Ltd, and its subsidiaries. The management of the company consists of recognized leaders and professionals from AML, compliance, anti-fraud and blockchain industries.

AMLT — fuel for the Coinfirm AML/CTF Platform and the transparent ecosystem

Although the Coinfirm AML/CTF Platform accepts payments in fiat and other cryptocurrencies, it is intended that activity in the Platform will eventually be performed primarily using AMLT and all purchases of AML Risk reports will be performed using AMLT. The principal purpose of a AMLT is therefore to operate as an ‘in-app token’ and an ‘access token’ that grants users access to the Coinfirm Platform and the services provided therein. AMLT will also offer discounts on fees charged within the Coinfirm AML/CTF Platform.

Another feature of AMLT is that it is the reward for Network Members who contribute their services to the ecosystem by providing identification and verification information (such as for information regarding public keys used in transactions with counterparties) and fulfilling certain other criteria that will.

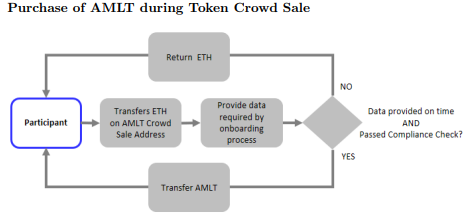

A participant who wants to purchase AMLT during the Token Crowd Sale needs to pass through the onboarding procedure after transferring ETH to the AMLT Crowd Sale Address. The Participant needs to provide for the compliance evaluation Participant’s Profile and Identity Data and Participant’s Ethereum Address from which the payment for AMLT is supposed to be made. In case the Participant does not provide all data required by onboarding process until AMLT Crowd Sale Timeout, providing this data would still be possible within 2 weeks after the Crowd Sale, the documents will be verified within a maximum 4 weeks after the Crowd Sale.

Tokens Distribution during Crowd Sale

Tokens available to public at launch: 210,000,000

Data rewards pool for Network Members: 120,000,000 (distributed monthly by the smart contract)

Consultants/Advisors: 2%

Ambassadors/Referrals: 1%

Founding Team: 10% (with lockup period)

Dev team and bonuses: 4% (with lockup period)

Foundation/Charity: 0,5%

Total AMLT Tokens generated in smart contract: 400,000,000

AMLT for User Applications

AMLT was designed to activate and be used by not only blockchain related entities but also the entire scope of actors from the traditional sector, including for example: companies, banks and financial institutions, legal entities and governments, some of which are already Coinfirm’s clients and partners. Users who want to purchase AMLT and become a compliant, active part of the ecosystem, need to pass through the AML/CTF and KYC check. The User provides his/her Profile and Identity Data as well as the Token Address devoted to hold AMLT. The User’s Token Address is verified on the Coinfirm AML/CTF Platform against suspicious transactions and the User’s Identity Data passes through standard KYC checks, e.g. appearance on sanctions lists.

Network Members are the key pillars of the AMLT ecosystem and are entitled to multiple benefits, including:

- SPEND — Services provided by Coinfirm’s AML/CTF Platform can be purchased with substantial discounts with the use of AMLT and even more by Network Members when paid with AMLT. These services will include AML Risk Reports, available through our API, in pdf or web format and their prices will be nominated in USD or other major fiat currency.

- HOLD — Network Members will gain access to the Knowledge Pool — the wide database of materials on AML for blockchain and virtual currencies, this includes: Articles, Webinars, Guidance on AML/CTF, Exemplary AML Policies, Procedures and Risk Matrixes. This toolkit is an essential part for any entity that wants to effectively manage AML risk on blockchain transactions. It is market unique and can substantially decrease AML expenses for both small entities and large corporates.

- GET REWARDS — Network Members will be entitled to obtain extra tokens coming from AMLT Monthly Distribution (periodic supply of newly created tokens, driven by token protocol), for providing specified data to the AMLT network. This data includes blockchain addresses with assigned data such as Profile data, Risk Indications, evidence, URLs. For example, the Network Member may report a donation address of a specific scam service with a supporting website address and pdf print screen. Once the provided data is validated by our team, the Token Addresses of Network Members who uploaded validated data are added to the payout list and AMLT Monthly Distribution amount is distributed between Network Members that provided validated data. The provided and anonymized data would then be made public for the sake of transparency and fair treatment of Network Members.

Network Members will need to comply with the requirements of Terms of Participation, expressing the good will and terms of participation in the AMLT network, which would include:

- Providing transparent and quality information;

- Taking no defamatory action against other AMLT users;

- Being diligent with AML/KYC obligations.

Description of functionalities :

- Access to the Coinfirm AML/CTF Platform and its services (Basic Report, C-Score, Standard Report, and Enterprise Report);

- Access to an exclusive Knowledge Pool including exclusive trainings, webinars, articles, guidance on AML/CTF Compliance but also applicable example policies, procedures and risk matrix’s;

- Possibility of being rewarded in AMLT for contributing data on virtual currency addresses to the Coinfirm AML/CTF Platform.

Certain benefits are exclusively available to Network Members. The following characteristics are required to become the Network Member :

- Hold 50,000 AMLT;

- Provides identification and verification information for AML/CTF/KYC requirements;

- Install Coinfirm’s Wallet;

- Provide their IP.

Benefits ONLY available to the Network Members:

- Discount % for services on the Coinfirm AML/CTF Platform ;

- Access to the exclusive Knowledge Pool of the Coinfirm AML/CTF Platform;

- Possibility of being rewarded in AMLT for contributing data on virtual currency addresses to the Coinfirm AML/CTF Platform.

Audited Token

The smart contract and token will be audited and tested

Realistic milestones

Create a transparent and mutually beneficial compliant blockchain ecosystem while becoming the global AML/CTF standard.

Safety of funds and compliance with AML/CTF and KYC regulations

Escrow will be implemented for at least 70% of the funds. AML/CTF and Compliance will be transparently run through the Coinfirm Platform (each AMLT holder will be rated) with other elements outsourced to a trusted third party provider.

Responsible antibug approach

Regular checks as well as a generous bug bounty policy.

Roadmap

- Pre 1.0 AMLT: Coinfirm AML/CTF Platform already provides AML/CTF solutions for the virtual currency ecosystem with global clients and partners ranging from some of the largest virtual currencies to major business intelligence companies and financial institutions. The system can be accessed online or via API. The easily adoptable and user friendly Platform allows users to complete their AML/CTF compliance model with transaction monitoring. The Coinfirm AML/CTF is blockchain agnostic and currently provides services for Bitcoin, Dash, and Ethereum.

- 1.0 AMLT: AMLT becomes the fully transparent access token of the Coinfirm AML/CTF Platform and network where in order to fully use the platfrom buy a report or access the API at discounted rates and access the Knowledge Pool with exclusive webinars, trainings, articles, draft policies, procedures, risk matrix’s on AML/CTF, AMLT and the status of Qualified User or Network Member is required.

- 2.0 AMLT: AMLT Wallet integrated with the Coinfirm AML/CTF Platform. Network Members that went through the identification and verification process on the Coinfirm AML/CTF Platform, obtained approval for a white label address and hold the minimum of amount of AMLT required are able to provide information to the Platform about virtual currency addresses (their own and others) in exchange for participation in the Monthly Distribution of AMLT generated by the smart contract. The contributions will be valued, and transactions will be calculated based on the value of the reported information. This will allow for full user privacy as well as a decentralized audit trail for users to ensure they received the correct payments for their input into the AMLT network.

AMLT Advantage Matrix

Team

Robert Ciurkot — COO at Coinfirm

Krzysztof Kr´ol — Product Owner

Marcin Rabenda — Product Owner

Beata Wi´snicka — Senior AML Analyst

Pylip Radionov — C++ Developer

Sebastian Gruza — Java

Developer Bartosz Zi¸eba — Developer Magdalena

Poprzeczko — Executive Assistant

Maksymilian Jaworski — Data Base

Administrator Lukasz Kranc — Frontend

Developer Filip Wieczy´nski — Business Developer

Advisors

Pawel Tomczuk, Chairman of the Advisory Board — CEO of JPGH & Associates, entrepreneur, founder of Ciszewski Financial Communications (successfully sold to Publicis Groupe ‘2011), investor & advisor to the board of numerous tech businesses across fintech, digital media and data. Mentor at Techstars, Startupbootcamp Fintech & Insurtech, Startup Grind and London Tech Advocate.

Ruth Wandh¨ofer, Blockchain Regulatory Advisor — Global Managing Director of Compliance & Market Strategy in Citibank, Regulatory and FinTech expert and one of the foremost authorities on banking regulatory matters, Ruth is a recognized global leader in the compliance space and chairs a number of influential industry bodies.

Julian Johnson, Strategic Advisor — CEO of MainSheet Ventures with 25- years of experience in the technology market and global sales executive roles at Oracle, Siebel, SAP, Microsoft and Salesforce. Julian has implemented major systems around the world and built an extensive career spanning several industries, including financial services, public sector, telecommunications and media,utilities and energy.

Founders

Pawe l Kuskowski, CEO, Co-founder — Entrepreneur, AML/CTF and recognized compliance advisor. A former head of global AML/CTF processes at major financial institutions such as RBS, Pawe l is a specialist in compliance and anti-money-laundering with extensive experience in conducting global projects for international financial institutions and cooperating with supervisory authorities. He is also the chairman of the Compliance Association of Poland.

Pawe l Aleksander, CIO, Co-founder — One of the more recognizable fraud prevention experts in Central Europe. Former Head of Fraud Investigations in ArcelorMittal, AML/CTF Project Manager in the Royal Bank of Scotland and fraud investigator and auditor in Ernst & Young. Pawe l holds the titles of Certified Fraud Examiner and Certified Internal Auditor. He has conducted numerous fraud and in-depth AML/CTF investigations in blockchain industry.

Jakub Fijo lek, CTO, Co-founder — An innovative IT and security specialist, Jakub has been analyzing and developing around blockchain, virtual currencies and their applications since 2010. Jakub is the former head of multi-algorithm virtual currency mining farms with vast experience in attacking, testing and creating the security systems around blockchain.

Grant Blaisdell, CMO, Co-founder — Creating models and ventures around tech and new media since his teens, Grant has been engrained as a visionary in both California and European startup ecosystems. Whether through his own projects or working with major companies, Grant has been pushing progress in the clash of tech and culture.

Maciej Zi´o lkowski, Co-founder — An international pioneering virtual currency adopter. Maciej has been involved in the Bitcoin and blockchain space since the early stages. He is a recognized author and speaker on the subject and co-founded the first Bitcoin establishment of its kind in Europe.

Ben Brophy, Delivery Director — One of the creators of blockchain movement around the financial area, Ben built and led the ENTIQ Blockchain LAB, is the CEO of BlockLab and the former Head of the Innovation Hub for Royal Bank of Scotland.

Details Information :

Website : https://amlt.coinfirm.io/

Whitepaper : https://amlt.coinfirm.io/pdf/white-paper.pdf

Facebook : https://web.facebook.com/AMLToken/?_rdc=1&_rdr

Twitter : https://twitter.com/AMLT_Token

Telegram : https://t.me/AMLT_Coinfirm

Linkedin : https://www.linkedin.com/company/coinfirm/

Profile Bitcointalk : https://bitcointalk.org/index.php?action=profile;u=1275057

ETH : 0x354B4485f6133537148382d7022Be1b3c98Dbf95

Tidak ada komentar:

Posting Komentar